Politics

European Parliament begins its 10th term

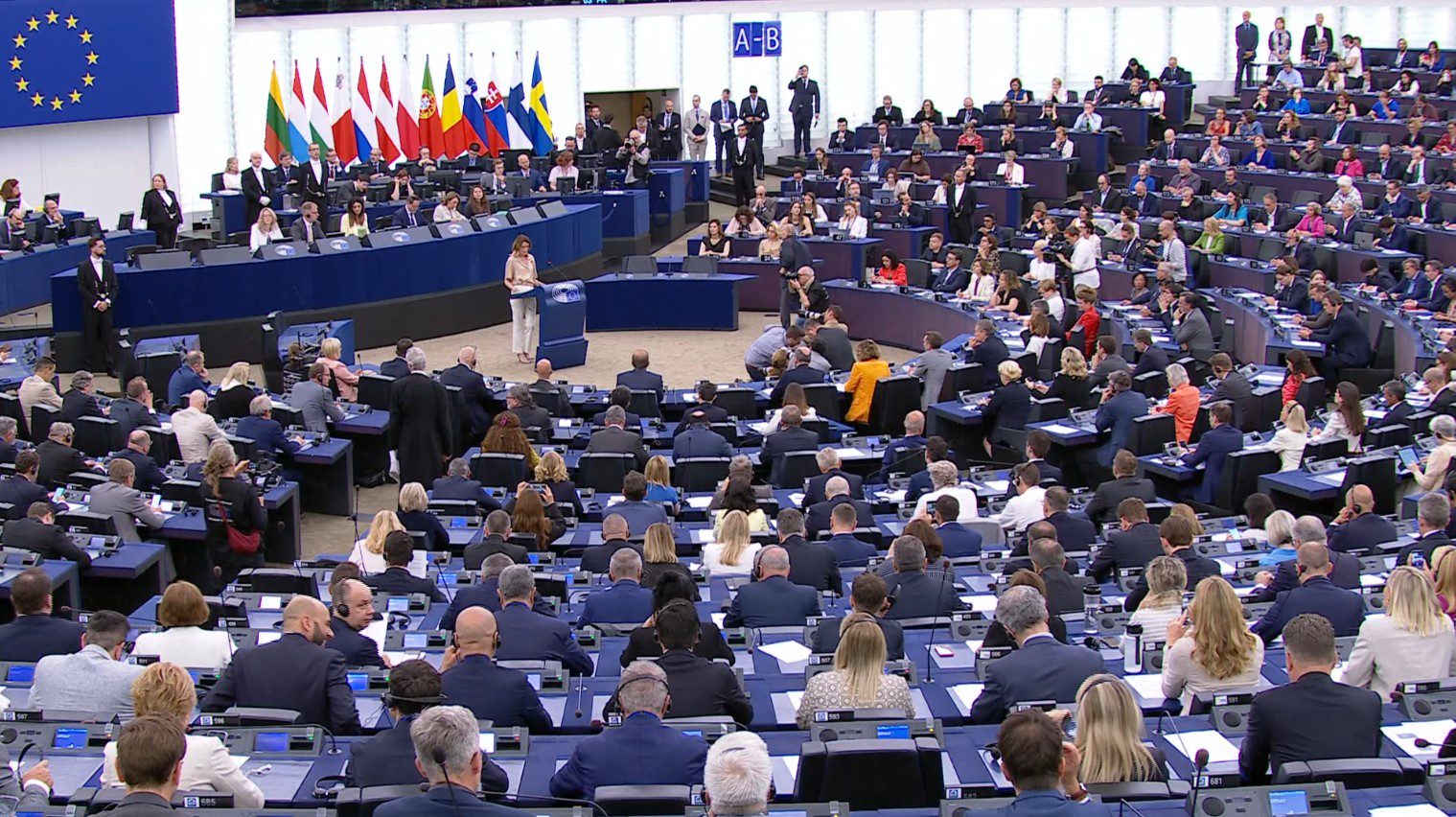

European Parliament Convenes in Strasbourg: New President to be Elected amid Growing Diversity

On a momentous Tuesday in Strasbourg, the European Parliament, following the recent European elections held on 6-9 June, officially commenced its proceedings. The session, presided over by the outgoing EP President, Roberta Metsola of the EPP from Malta, commenced with a musical interlude before Pina Picierno, the second Vice-President in the outgoing Parliament from Italy’s S&D, announced the contenders for the coveted Presidency of the Parliament.

The highly anticipated vote, conducted through a secret paper ballot, is set to occur immediately after the inaugural session. To ensure a fair process, eight MEPs, selected by lot, will oversee the election proceedings.

The distinguished candidates vying for the Presidency are Roberta Metsola representing EPP from Malta and Irene Montero from The Left in Spain. Ahead of the crucial vote, both candidates delivered succinct statements to the plenary, outlining their visions for the future of the European Parliament.

To attain victory, a candidate must secure an absolute majority of valid votes cast, which equates to 50% plus one. In the event of no clear winner in the initial round of voting, subsequent rounds may follow with the possibility of new or existing candidates being nominated under the same stipulations. If needed, a third round could ensue with the same regulations. Should no candidate emerge victorious after the third round, the two candidates with the highest votes in this round will advance to a decisive fourth and final round, with the majority winner emerging triumphant.

Upon the election of the new President, the distinguished individual will assume the leadership position and deliver a notable opening address, setting the tone for the parliamentary term ahead.

In this landmark tenth term, the European Parliament boasts 720 seats, an increase of 15 from the previous legislature. Notably, 54% of MEPs are fresh faces, marking a slight decrease from the 2019 intake of 61%, with the representation of women comprising 39%, down marginally from the 40% mark in 2019.

Among the diverse MEP cohort, Lena Schilling, a 23-year-old from Austria representing Greens/EFA, stands as the youngest member, while the seasoned Leoluca Orlando from Italy, a Green/EFA representative aged 77, holds the distinction of the oldest MEP. The average age of MEPs stands at 50, reflecting a diverse range of experiences and perspectives within the parliamentary body.

As the tenth term commences, the European Parliament encompasses eight political groups, an increase from the previous session. Additionally, 32 MEPs remain non-attached, underscoring the dynamic landscape of political affiliations within the Parliament and highlighting the vibrant tapestry of representation in the European legislative body.

Politics

How To Promote Solidarity – Shared Migration Policies Within The EU

Most EU citizens seek a peaceful coexistence in a diverse society, yet the complexities surrounding migration policies can create division. Understanding the importance of solidarity in shared migration policies is vital for fostering a more inclusive environment. In this post, you will discover effective methods to advocate for unity while navigating the challenges of migration, ensuring that your voice contributes to a positive change across Europe. By implementing these strategies, you can play a pivotal role in shaping a compassionate, welcoming future for migrants and host communities alike.

Understanding Solidarity

While the concept of solidarity within the European Union (EU) is often viewed as a moral imperative, it is integral to the efficacy of shared migration policies. Solidarity encourages cooperation among member states, fostering a sense of shared responsibility. This is particularly significant in the context of migration, where challenges can be unevenly distributed. A united approach enables the EU to respond more effectively to humanitarian crises and to support those nations that face disproportionate pressures from incoming migrants.

The Importance of Solidarity in Migration Policies

To understand the dynamics of migration within the EU, it is imperative to recognise that solidarity is not just a philosophical notion but a practical necessity. By working together, member states can develop robust migration frameworks that ensure the humane treatment of migrants while maintaining national security. Solidarity embodies shared values—human rights, dignity, and respect—that are integral to the fabric of European identity. This commitment can galvanise collective action aimed at creating more comprehensive solutions.

Key Factors Influencing Solidarity Within the EU

An array of factors shapes the level of solidarity among EU member states, influencing their migration policies. These factors include economic disparities, political climates, historical contexts, and public attitudes towards migrants. To reinforce solidarity, it is vital to address inequality by ensuring that resources are equitably shared. Furthermore, fostering a sense of community among European nations can enhance collaborative efforts in responding to migration issues. The interplay of these elements often determines the degree of political will to act in harmony.

- economic disparities

- political climates

- historical contexts

- public attitudes

Policies that reinforce solidarity must actively engage with varying historical narratives and national identities that shape public perceptions of migration. Engaging communities through education and outreach can help dispel myths and build empathy towards migrants. Additionally, encouraging governments to create inclusive frameworks will lead to better integration of migrants into local societies. A concerted effort is needed to pursue policies that reflect the shared values of the EU while addressing the real concerns of member states.

- inclusive frameworks

- public perceptions

- community engagement

- collaborative action

Knowing how these factors interact not only enhances your understanding of solidarity but also empowers you to advocate for better policies that uphold the values and principles of the European Union.

How To Promote Solidarity

Any efforts to promote solidarity within the EU should begin by establishing effective policies that are tailored to the unique needs of each member state while considering the broader picture. Cooperation between nations can be facilitated through shared migration policies that prioritise human rights and ensure that the challenges faced by migrants are met with compassion and pragmatism. To achieve this, you need to foster open dialogue amongst decision-makers that will allow for *mutual understanding* and *collective responsibility*. Your ability to advocate for these shared goals can significantly influence the effectiveness of policies that promote integration and social cohesion.

Tips for Policy Makers

With practical strategies in mind, your role as a policy maker requires actionable steps to strengthen the EU’s commitment to solidarity. Consider implementing the following ideas:

- Encourage bilateral agreements between member states to address specific migration challenges.

- Promote funding initiatives to support local projects aimed at migrant integration.

- Facilitate public awareness campaigns that highlight the contributions of migrants to society.

- Implement training programmes for officials to better serve diverse communities.

Thou must persistently advocate for a culture of solidarity through unwavering commitment and innovative practices.

Community Engagement Strategies

Now, engaging with communities is pivotal in fostering a collective sense of responsibility towards migrants. By actively involving local residents in initiatives, you can create an environment where everyone feels valued, and misconceptions are dismantled. This can be achieved through collaborative projects, community events, and open forums that not only educate but also empower individuals to act. You should focus on fostering relationships between migrants and locals, thereby enhancing social cohesion and mutual respect within the community.

Solidarity can be cultivated through active participation in community-led initiatives, ensuring that both migrants and locals share their experiences and challenges. By creating safe spaces for dialogue, you effectively dismantle barriers and enable the development of a united front against discrimination and xenophobia. It is imperative to emphasise that involving both groups in decision-making processes strengthens community bonds and lays the groundwork for more inclusive policies. This communal effort not only illustrates the importance of shared values but also champions a positive narrative that all can rally behind.

Establishing Shared Migration Policies

It is imperative to create a coherent framework for migration policies within the EU that fosters mutual benefit and addresses the needs of both migrants and host countries. This necessitates the establishment of shared migration policies that facilitate cooperation among member states. Your engagement in discussions surrounding Solidarity under EU asylum policy with the New Pact on … will play a significant role in shaping these policies. A unifying approach not only addresses humanitarian concerns but also enhances the overall stability of the EU, fostering solidarity during times of increased migration pressures.

Best Practices for Implementation

Now is the time for you to turn theory into practice by focusing on successful case studies within the EU. For instance, collaborative initiatives that champion both local community support and migrant integration have worked effectively in various member states. These best practices showcase how local authorities can engage citizens in welcoming migrants, thus mitigating social tensions and enhancing public acceptance. You can facilitate these initiatives by sharing resources and fostering partnerships between local governments and NGOs to ensure your migration policies are effectively implemented.

Overcoming Challenges in Policy Development

Any attempts to develop shared migration policies will inevitably face challenges, from political reluctance to logistical barriers. You must acknowledge that differing national priorities and perspectives on migration can create a complex environment in which policy cohesion is difficult to achieve. Collaborative approaches that promote understanding and address common goals are necessary for overcoming these hurdles.

Best practices include intentional dialogue between member states, ensuring clear communication of objectives, and fostering a spirit of cooperation. By understanding that challenges such as differing economic conditions or public sentiment towards migrants can jeopardise successful policy implementation, you equip yourself with the knowledge to advocate for solutions. With the right strategies in place, the EU can transform these challenges into opportunities for a more integrated and peaceful approach to migration policy.

Enhancing Collaboration Among Member States

To foster effective migration policies across the EU, you must recognise that collaboration among member states is necessary. By working collectively, you can share resources, strategies, and best practices, significantly improving the handling of migration challenges. This cooperation not only strengthens the policies in place but also promotes a sense of solidarity, enabling you to create a more cohesive approach to migration management throughout the EU.

Building Networks for Support

On the journey towards more integrated migration policies, building networks among member states is paramount. As you engage with other nations, you can establish partnerships that facilitate mutual support and create a unified front against the complexities of migration. By connecting with various stakeholders, you can share experiences and solutions, leading to improved outcomes for both migrants and receiving communities.

Facilitating Information Exchange

States must prioritise the sharing of vital information regarding migration patterns, policies, and best practices. Through enhanced communication channels, you can better understand the challenges faced by other member states and the solutions they have implemented. This knowledge exchange empowers you to adopt more effective approaches, thereby strengthening your migration framework.

Facilitating information exchange should involve the creation of centralised databases and platforms where you can access and share data freely. By making relevant information readily available, you ensure that your policies are informed by the latest developments and challenges faced by other EU countries. This collaborative effort diminishes the risk of overlapping strategies and promotes tailored responses to migration issues, ultimately leading to a more effective, cohesive policy framework across the European Union.

Monitoring and Evaluating Solidarity Efforts

Many countries within the EU are learning that effective monitoring and evaluation systems are imperative for assessing the implementation and impact of solidarity in shared migration policies. You must ensure that these systems are not just perfunctory; instead, they should provide you with meaningful insights into how policies affect migrants and host communities alike. This also includes analysing the social, economic, and cultural implications of your solidarity efforts, allowing you to refine your strategies continually. Without such systems in place, it would be nearly impossible to gauge the effectiveness of the initiatives undertaken and identify areas that require improvement.

Assessment Metrics

Assuming you want to assess the impact of your solidarity measures accurately, implementing a robust set of assessment metrics is indispensable. These metrics should encompass both qualitative and quantitative measures that evaluate not only the immediate outcomes of your policies but also their long-term sustainability. For example, tracking the rates of integration of migrants, their access to health and education services, and public perceptions of migrants can provide a valuable snapshot of how your shared policies are performing. Ensuring that these metrics are aligned with EU-wide standards will facilitate cross-country comparisons and enhance accountability.

Adapting Policies Based on Feedback

For your policies to remain effective, you need to remain flexible and open to incorporating feedback from various stakeholders, including migrants themselves. By establishing feedback loops, you can gain invaluable insights into the lived experiences of those impacted by your initiatives. This adaptive approach enables you to identify what works, what doesn’t, and where adjustments are necessary to improve the overall effectiveness of your shared migration policies.

Another important aspect of adapting policies based on feedback is the involvement of local communities and organisations. Engaging with these stakeholders allows you to draw upon their expertise and ground-level observations, thereby enriching your understanding of the challenges faced by migrants. Furthermore, listening to different voices enhances community cohesion and reduces resistance to migratory policies, ultimately leading to more effective and inclusive approaches that benefit everyone involved. In such a manner, your solidarity efforts can evolve and better respond to the dynamic landscape of migration in the EU.

Encouraging Public Support for Migration Solidarity

Now, fostering a supportive environment for migration solidarity within communities begins with effective communication. By raising awareness and understanding about the benefits of migration, you can help reshape the narrative around this important issue. Engaging in public discussions, social media campaigns, and local events will allow you to highlight how migration enriches your society, contributes to the economy, and fosters diversity. When individuals can see the tangible positive impacts of migration, they may become more inclined to support shared migration policies.

Raising Awareness and Understanding

Solidarity is rooted in knowledge, and promoting a better understanding of migration can significantly enhance public support. You can take the initiative to organise workshops, informational sessions, or community forums where people can learn about the real stories and experiences of migrants. Sharing statistics and evidence of how migrants contribute positively to your community can dispel myths and misconceptions. By transforming fear and uncertainty into informed opinions, you empower your peers to support migration solidarity actively.

Addressing Misconceptions and Fears

Any efforts to build solidarity must address the misconceptions and fears surrounding migration. Many people harbour irrational fears about migrants taking jobs or infringing on community resources. You can play a pivotal role in dismantling these arguments by providing data that demonstrates how migrants often fill critical gaps in the labour market and contribute to economic growth. Engaging with sceptics through informed conversations can create a more receptive atmosphere for shared migration policies.

Support for migration solidarity requires a proactive approach in tackling the general misconceptions that might pervade your community. It is vital to show that the integration of migrants often leads to a more vibrant, culturally rich environment, counterbalancing misplaced fears of resource competition. Highlighting personal stories of migrants can foster empathy, and reminding your peers that we all share common human experiences can pave the way for a more supportive stance towards shared migration policies. Your voice and actions can significantly affect how migration is perceived and supported within the community.

Conclusion

With this in mind, it is crucial that you actively engage in the promotion of solidarity across shared migration policies within the EU. By advocating for comprehensive strategies that facilitate the fair distribution of migrants and refugees, you can contribute to a more unified approach among member states. Fostering partnerships that encourage collaboration will not only enhance the overall resilience of the European Union but also strengthen the social fabric of your local communities, ensuring that integration and support mechanisms are effectively implemented.

Furthermore, by staying informed and educating others about the benefits of solidarity in migration, you can play a pivotal role in shaping public opinion and policy. Emphasising the shared responsibilities among nations can lead to a more empathetic response to the challenges faced by migrants. By participating in discussions, raising awareness, and supporting initiatives aimed at reinforcing solidarity, you empower yourself and others to contribute to a more harmonious and equitable European Union, setting a positive precedent for future generations.

FAQ

Q: What is the concept of solidarity in relation to migration policies within the EU?

A: Solidarity within the context of EU migration policies refers to the collective responsibility of member states to support and assist each other in managing migration effectively. This involves sharing the burdens and benefits of migration, ensuring that all countries contribute to the integration and support of migrants, regardless of their individual circumstances or capabilities.

Q: Why is shared migration policy important for EU member states?

A: Shared migration policy is vital for EU member states as it promotes a unified approach to handling migration challenges. By collaborating, countries can enhance their capacity to provide humanitarian assistance, maintain security, and leverage resources effectively. It also helps prevent situations where some countries bear a disproportionately high burden of migration, fostering a sense of unity and mutual support among nations.

Q: What strategies can EU countries adopt to foster solidarity in migration policies?

A: EU countries can adopt various strategies to encourage solidarity, such as establishing fair relocation mechanisms for asylum seekers, creating joint funding initiatives to support local integration efforts, and sharing best practices regarding migrant services. Additionally, fostering dialogue and cooperation among member states can help to build trust and ensure a coordinated response to migration challenges.

Q: How can civil society contribute to promoting solidarity in EU migration policies?

A: Civil society plays a significant role in promoting solidarity by voicing the needs and rights of migrants, mobilising public opinion, and advocating for inclusive policies. Non-governmental organisations and community groups can provide vital support services to migrants, facilitating their integration. Furthermore, they can work with governments to influence policy formation and promote a culture of understanding and acceptance towards migration.

Q: What role does public perception play in the success of shared migration policies in the EU?

A: Public perception is a significant factor in the success of shared migration policies within the EU. Positive public attitudes towards migrants and the benefits of migration can enhance support for solidarity initiatives. Conversely, negative perceptions can lead to resistance against migration policies. Education and awareness campaigns can help to dispel myths and foster a more inclusive environment, thereby promoting the success of shared migration efforts across member states.

Politics

Kosovo- Statement by the Spokesperson on the latest developments

EU Warns of Escalating Tensions After Kosovo’s Public Service Closures

The European Union has issued a sharp rebuke of Kosovo’s recent police operations targeting public service providers in the north of the country, warning that such measures risk deepening divisions and damaging its international reputation. In a statement released on May 16, 2025, the European External Action Service (EEAS) expressed concern over actions against key infrastructure, including the Vodovod Ibar water company in Mitrovica North and the public utility company in Zubin Potok, which serve predominantly Serb communities .

The EU criticized the unilateral closures as “escalatory” and urged outgoing Prime Minister Albin Kurti to halt further actions, emphasizing that such moves undermine trust between Kosovo’s communities and destabilize efforts to normalize relations with Serbia. “Unilateral and uncoordinated actions undermine efforts toward building trust between communities,” the statement read .

This is not the first time the EU has condemned Kosovo’s approach. Earlier in 2025, similar operations during an election campaign sparked warnings about their potential to inflame tensions, particularly when targeting Serbia-backed institutions . The current measures echo past disputes, reigniting fears of institutional fragility ahead of Kosovo’s political transition.

The EEAS reiterated calls for both Kosovo and Serbia to resume constructive dialogue under the EU-facilitated normalization process, stressing the urgent need to implement existing agreements, including the long-delayed establishment of a Serb-majority municipalities community. “Normalization of relations is an essential condition on the European path for both Parties,” the statement emphasized .

Recent Security Council reports have highlighted a lack of progress in Belgrade-Pristina talks, underscoring the EU’s frustration with stalled diplomacy . The bloc’s latest intervention signals growing impatience with unilateral actions that threaten to derail Kosovo’s EU accession prospects and regional stability.

As Kosovo faces domestic political uncertainty following Thaçi’s resignation earlier this year , the EU’s message underscores the delicate balance between enforcing state authority and maintaining intercommunal cohesion—a challenge that will define the country’s European integration trajectory.

Kosovo- Statement by the Spokesperson on the latest developments

Source link

Politics

EU Leaders Unite in Reaffirming Support for Moldova’s European Future

Joint statement by the leaders of France, Germany, Italy, Poland, Romania, the United Kingdom, the President of the European Council and the President of the European Commission after a meeting with President Maia Sandu of Moldova (16 May 2025)

On the sidelines of the sixth European Political Community summit in Tirana, Albania, leaders from France, Germany, Italy, Poland, Romania, the United Kingdom, along with the Presidents of the European Council and European Commission, issued a joint statement on Friday reaffirming unwavering support for Moldova’s European integration 3. The meeting with Moldovan President Maia Sandu underscored collective backing for the country’s democratic reforms and resilience amid regional challenges.

The statement emphasized Moldova’s constitutional commitment to EU membership—a move reflecting the “clear choice” of its citizens for a future within Europe 2. Leaders praised the government’s efforts to strengthen the rule of law and democratic institutions, while pledging continued assistance to bolster economic growth, job creation, and investment. “Moldova’s economic transformation is central to this vision,” the statement read, highlighting plans to enhance competitiveness and living standards.

Regional stability was another focal point, with Moldova commended for maintaining security despite its precarious geopolitical environment. The leaders stressed the importance of free and fair parliamentary elections later this year, urging vigilance against foreign interference. “We will continue to support Moldova in safeguarding its democratic processes,” the statement noted, underscoring the EU’s role in reinforcing resilience.

The meeting comes amid heightened scrutiny of Moldova’s pro-European trajectory, particularly as it navigates internal political tensions and external pressures from Russia. By aligning their message with the European Political Community’s broader goal of fostering unity across the continent 3, the leaders signaled that Moldova’s accession prospects remain a strategic priority for the bloc.

Moldovan President Sandu, who has spearheaded her country’s pro-EU agenda, welcomed the solidarity, calling it a “critical step toward fulfilling our shared vision of a peaceful, united Europe.” The statement reaffirms Moldova’s place within the EU’s eastern enlargement framework, though challenges persist in aligning reforms with accession criteria.

As Moldova prepares for pivotal elections and deeper integration talks, the EU’s unified stance aims to counter disinformation campaigns and external destabilization efforts. With leaders from major EU powers and institutions standing together, the message to Chisinau is clear: its European path remains both a national aspiration and a continental imperative.

The leaders of France, Germany, Italy, Poland, Romania, the United Kingdom, together with European Council and European Commission Presidents met with President of Moldova and reaffirmed their strong and united support for Moldova and its European future.

Source link

-

EU & the World3 days ago

Who Is Valeria Marquez? About the Influencer Who Was Shot During Livestream

-

EU & the World4 days ago

Cardi B & Offset’s Relationship Timeline: From Marriage To Cheating Drama & Split

-

Politics5 days ago

EU Assesses Support for Ukrainian Refugees: Challenges and Flexibility in Humanitarian Response

-

EU & the World1 day ago

Chris Brown Tour 2025: Updates on Concert Dates, Cities, Ticket Prices & More

-

Sports6 days ago

Matteo Berrettini forced to retire amid tears at Internazionali d'Italia

-

EU & the World2 days ago

Who Is Ben Cohen? About the Ben & Jerry’s Co-Founder Who Was Arrested During Senate Hearing

-

Travel4 days ago

Crete earthquake: Is it safe to travel to the Greek island following tsunami warning?

-

Sports7 days ago

Clásico da leggenda: Barcelona wins back Real 4-3, La Liga one step away