EU & the World

[Interview] Paolo Gentiloni : “We Still Need Growth”

![[interview]-paolo-gentiloni-:-“we-still-need-growth”](https://eurotimes.eu/wp-content/uploads/2023/05/1221-interview-paolo-gentiloni-we-still-need-growth.jpg)

The European Green Deal commits EU to pursuing green growth. The European Treaties require national governments to ensure that their GDP is in line their public debt. Is the European Union addicted to growth?

We asked European Economy Commissioner Paolo Gentiloni, and Co-President Philippe Lamberts of the Greens/EFA Group at the European Parliament if Europe could fight inequality and protect our planet without growth.

Jamie Kendrick – Should the European Union accept economic growth has ended?

Paolo GentiloniI hope not. Here, two distinct but related conversations overlap. There is a discussion on “beyond” growth, which means quality, sustainable growth, beyond GDP. It is a reflection about how to expand our assessment of growth beyond traditional parameters and include other qualitative measurements such as the Sustainable Development Goals. This sustainable growth is what we need. There is also a parallel discussion on whether growth is needed.

The easy part is to say, yes, growth is needed. Beyond growth, we have recession, stagnation and austerity. Discussions on fiscal policies, green transformation and innovation are also about growth. I agree with the message that growth cannot be measured solely by GDP. Arguments that the growth era is over would be dangerous. In a low growth environment — let alone one with no growth — tackling inequality and the green transformation becomes very difficult.

But pushing for more growth also means pushing against the limits of the environment and people. Isn’t growth and prosperity incompatible?

Philippe LambertsThe question is: Can there be sustainable growth? Growth is the size measured in monetary value of the economy, correct? Growth means a larger economy. We can only achieve this if we completely decouple the size and impact of the economy on the planet. Science has not found this to be possible.

Energy is the backbone of any economy. As such, if you want to grow your economy, you will always need more energy. In the second half 2022, the European Union will have reduced its energy consumption by 20% without shrinking their economy by 20%. This is a great achievement, relative decoupling. But if we wanted to completely decouple our economy from energy and material and lower our emission, I don’t think that was possible. You’ll reach a limit at some point, so I doubt the feasibility of unlimited growth.

If we accept the fact that there are limits on economic growth, then distribution becomes a much more important issue. Everyone can get a piece of the pie when it is growing. In reality, everyone gets a piece of the pie. This is where we are at the moment.

Paolo GentiloniIt’s our responsibility to find a positive response to this question and demonstrate that sustainable growth is achievable. We are in a very tough situation if we don’t. We must do everything possible to reduce our impact: energy saving, biodiversity protection, product design, the right to repair, etc. But we still require growth.

Growth has always been the key to reducing inequality. Who knows what the future will bring, but the slow growth in the European Union during the last 10-15 years only made inequality worse.

Philippe LambertsThis was a decision made by a politician. Since the global financial crisis, and the eurozone crises, the people at the lower end have been the hardest hit. It didn’t need to be this way. The losses should have been borne by bondholders and bank shareholders… but we were more concerned about the economy and growth, and they ended up richer than ever.

Paolo GentiloniI don’t deny that theory at all. But look at the historical record of inequality. Take Thomas Piketty’s A Brief History of Equality. The trend of inequality has been reduced substantially during periods of high growth. Could we theoretically do it differently? Possibly. Human nature is what it’s like, and it’s much easier to work towards sustainable growth than it is to try and achieve increased prosperity and equal opportunity with a declining economic.

The EU has committed itself to green growth as a solution to the climate problem. The United States and China do the same. Isn’t Europe’s transition to green a need for a new social system, rather than a race for competitiveness with all its pressure on people and the planet?

Paolo GentiloniI can see the risks. We say that we are going to go green, for a net-zero industrial sector, but we then rush to compete on an horizon based upon the same model, the same systems, and exploitation of the same old mechanisms. If we want to see things positively, then I also see a shift in culture and behaviour.

The COVID lockdowns have changed the way we work and our relationship to our jobs. I’ve never witnessed such a massive shift in consumer, household and family behaviour. This is bringing green transition to the ground. Many people are thinking about different ways to work or move around our cities. The European conversation about working time has been reopened.

We can make progress if we keep pushing in the right direction. In times of high inflation it is not easy. Redistribution is important, because we are currently facing a loss in purchasing power for many and high profits within certain sectors. This was the logic behind the EU-level contribution to the excess profits of energy firms.

Philippe LambertsI wouldn’t consider competitiveness a bad thing. Competitiveness is basically a comparison between two ratios: The ratio between your value and cost, and the same ratio of someone else. We tend to limit the concept of competitiveness to wages. However, this is actually cost competitiveness. Europe cannot be a continent of low costs. We don’t want Europe to be a cheap continent, but rather a high-value one.

The green transition is a way to boost Europe’s competitiveness, because we are targeting the high-value market. This is the only way you can guarantee a high standard of living. We should strive to create high-value goods at low energy and resource costs, with high wages and conditions of work.

In many European countries we see high tensions on the labour market. The bargaining power should be in favour of workers and not the capital owners. They are competing for the best employees. If the basic conditions on the labour market ensure that the distribution is more equitable, you have already solved a part of the problem. You do not need to rely so heavily on distribution policies.

Long ago, it was believed that governments should keep their public debt low in order to maintain high levels of economic growth. Now, governments are taking on debt in order to fight crises and invest in the green transformation, reduce inequality, and rebuild their militaries. What does all this public commitment mean for the EU’s macroeconomic governance system?

Paolo GentiloniIn recent years, the debt levels of European nations have increased significantly. The EU treaties established a benchmark for EU governments of 60 per cent debt to GDP. The idea was not proposed by a Nobel Prize-winner. It was the average debt of 12 countries who signed the Maastricht Treaty. Now, the average debt of these 12 countries is 83 percent.

This continuous increase in the debt is not good. Some countries have high levels of debt that could pose a stability problem. In the past, we interpreted the rules in the Stability and Growth Pact so that the emphasis was on stability and not much on growth. It was a mistake back then, and it would be one now, with the mountain of investments we have to make for the green transformation and competitiveness. These challenges require private investments, but the government also has a role to play. Nobody denies this, not in America, not China, or in Europe.

Brussels is changing its mind-set. Can you change the mind-set without money? In 2020, Europe took the bold decision to create a program unprecedented in funding the recovery from pandemics with 800 billion Euros. We need to commit as a group if we are serious about the transition to a greener economy. The green transition is going to be a huge effort, and there will be times when we will have to face many costs with no new revenue. This is true for the automobile industry as well as the renovation of buildings. We cannot solve these problems by easing state aid rules and attracting private investment. Otherwise, we will see too much divergence among EU countries.

We will face higher debts, but we must avoid the same mistake we made after the financial crises when we cut back on public investment.

Philippe LambertsThe public debt should be compared to the net capital position of the government. If the debt is a result of better energy infrastructures and higher education levels, the ability to produce useful goods and services, or resilience against environmental disasters, then it’s fine. If you use debt to fund your ordinary expenses, you have a problem.

We should never forget there are two ways of funding public expenditures: debt and taxes. I know that the T-word is not for everyone, but higher taxes and fairer taxation are democratic choices. We need to take a rational approach to the sustainability and stability of public finances when we examine the fiscal rules of European Union. We owe the taxpayers a duty to spend money efficiently and effectively. We need democratic scrutiny, pressure, and arbitration. If you don’t, you run the risk of creating white elephants in terms of the timing of climate change on the sustainability and public finances.

The Greens/EFA Group in the European Parliament studied the impact of timing on climate action and the sustainability of public finance. The study concluded that the sooner you start investing, the better off your public debt will be. If you’re going to spend 100bn euros of public money for climate change, it’s better to do it now than pay a larger bill later.

We are currently catching up on private and public investments. We can expect debt to increase when you accelerate investment. But long-lasting investments such as high-quality railway networks and water systems will pay off for us and our children.

One of the proposals of postgrowth and beyond-GDP economists is to place a range of wellbeing indicators at the heart of our economic decisions. We are reforming EU fiscal rules. Couldn’t we pay as much attention to air pollution, or the quality and quantity of public housing, as we do to the two relatively reductive measures GDP and debt?

Paolo GentiloniThere are a few steps in this direction but the fact remains that money is still money, debt is still debt, and the rest of the tree is just a Christmas one.

As part of its economic monitoring, the EU has been publishing an Annual Growth Survey for the past 12 years. Since 2020, the document has been renamed to the Annual Sustainable Growth Survey in order to take into account the social and employment dimensions and, more recent, the Sustainable Development Goals. I agree that environmental issues should be considered in our debt sustainability analysis. Businesses and central banks are also doing this. It is a long and difficult process to change your mindset. The contribution of the European Parliament can be very significant in this area, as the need for change is more apparent there than amongst the member states.

Philippe LambertsIt’s almost a theological discussion because some people regard benchmarks like 3 percent deficit spending and 60% debt levels as holy. Many economic models are based upon assumptions that are totally ignorant of the reality of this world. Let’s start with energy.

Fossil fuels are concentrated energy that has been built up over millions and millions of years. They are a geological wonder that has created the illusion of cheap, abundant energy. Wind and solar energy is less efficient than burning oil from the ground. We must re-learn how energy behaves, and factor that into our models.

The same goes for the cost of inaction. Wallonia, a region in Belgium, has a public finances that are not in the best shape. Wallonia will be hit by flooding in 2021 that will cost 5 billion Euros, a large part of which is going to be covered by the public sector. Climate change and its effects cannot be excluded from economic models. When you look at the European Economy as a Whole, we need to develop new models that can prevent and pre-empt these types of shocks.

The Beyond Growth Conference is a collective exercise in thought. We are trying to make progress in the way we think about systemic implications, and integrate this new complexity into the way we think about Europe’s economy and European society.

This article was published as part of Growth Week in collaboration with European Green Journal. Continue reading in the Growth Week section.

EU & the World

Nicole Kidman ‘Didn’t Feel Exploited’ Filming Erotic Scenes in ‘Babygirl’ Movie

The actress previously told ‘Vanity Fair’ that she felt ‘very exposed’ while working on ‘Babygirl.’

EU & the World

Adam Brody to Star as Hot Rabbi in Netflix Film ‘Nobody Wants This’

Adam Brody will play a hot rabbi in Netflix’s ‘Nobody Want This’ starring alongside his on-screen love interest Kristen Bell.

EU & the World

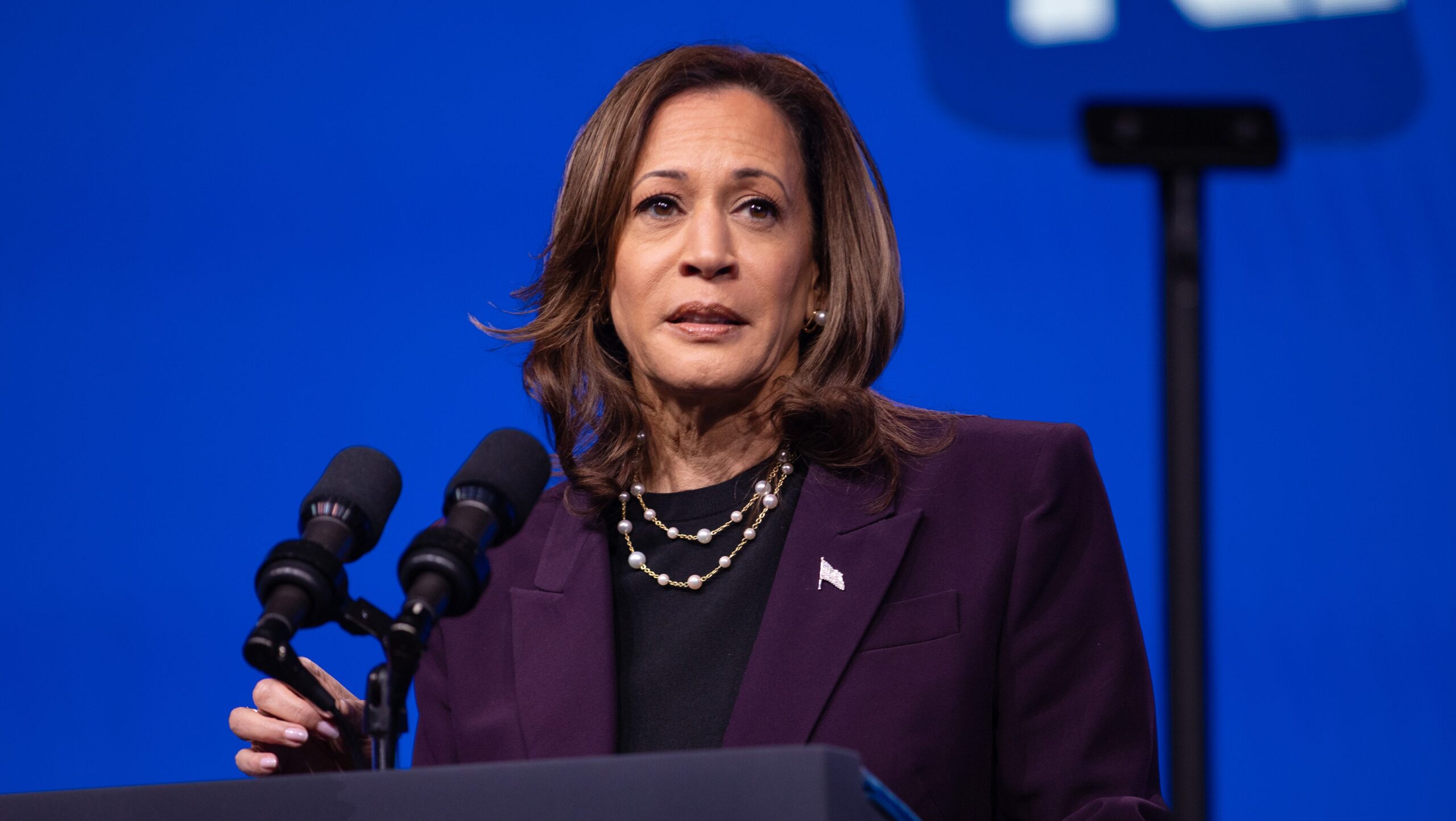

JD Vance Mocks Kamala Harris’ CNN Interview

Donald Trump’s running mate compared the vice president’s CNN interview to former Miss South Carolina Caitlin Upton’s 2007 speech.

-

Sports23 hours ago

Sports23 hours agoMercedes celebrates Monza: “Goosebumps.”

-

Politics6 days ago

Politics6 days agoThe Russian patriarch to Putin: You are the first truly Orthodox president

-

Sports3 days ago

Sports3 days agoFiorentina closes the market with three strikes

-

Politics2 days ago

Politics2 days agoEuropean Parliament begins its 10th term

-

Politics5 days ago

Politics5 days agoEU Intensifies Pressure: Six-Month Extension of Russia Sanctions

-

Health & Society4 days ago

Health & Society4 days ago7 Superfoods That Will Boost Your Fitness Results

-

EU & the World6 days ago

EU & the World6 days agoBrittany Cartwright Files for Divorce From Jax Taylor After 5 Years of Marriage

-

Sports5 days ago

Sports5 days agoUS Open, Matteo Berrettini’s adventure is already over