Business

Davos 2023: The 5 key talking points set to dominate the agenda at this year’s World Economic Forum

The World Economic Forum (WEF) is gearing up for its annual meeting in the Swiss resort of Davos this week. It will be the first time since the COVID-19 pandemic swept the globe that the event will return to its former scale last seen in 2020.

In the coming week, 50 heads of state and government from a mix of G20 and G7 countries are due to attend, as well as 200 cabinet ministers and 1,500 business leaders. All in all, 130 countries from around the world will be represented at the meeting in the picturesque town high in the Swiss Alps.

As with every previous meeting, the most pressing issues facing the world today will be up for discussion as the 2,700 invited speakers grapple to find potential solutions.

The theme of the 2023 meeting is “Cooperation in a fragmented world”. But which global challenge will be top of their agenda to tackle first?

These are set to be the key talking points this year.

The cost of living crisis

Experts at WEF are describing 2023 as the “year of the polycrisis,” a year in which all the problems humanity is facing have become more interwoven, more reciprocally damaging than ever and ultimately harder to solve.

In the short term, these problems are being boiled down to one key challenge: the cost of living crisis.

A majority of WEF’s Community of Chief Economists are expecting a global recession this year as a result of geopolitical and economic tailwinds from the war in Ukraine coupled with crippling inflation.

In order to avoid the worst possible scenarios, heads of government and central bank governors – many of whom will be attending Davos this year – are facing the inevitable dilemma of whether to spend more money on their citizens to shield them from the biting cost of living crisis or hike interest rates to fight inflation which in turn risks unleashing a global recession.

The ongoing war in Ukraine

Russia’s invasion of Ukraine dominated WEF’s exceptional spring meeting last May, which took place just three months after the first strikes on Ukrainian territory.

As was the case in May, Ukraine’s president Volodymyr Zelenskyy is slated to address the event via video link. Furthermore, for the second consecutive year, Russia will not have a presence at Davos with their traditional embassy Russia House (which in May was repurposed as the Russian War Crimes House), now taken over by the delegation from Maharashtra in India.

The ongoing conflict remains one of the most pressing issues being discussed this year, not least because of its implications for global security, defence policies, energy, and food production.

As well as its own “house” on the Promenade, Davos’ main thoroughfare, there is expected to be another sizeable Ukrainian delegation present – including government ministers – at the event to continue to lobby for international support.

The climate crisis

As has become the norm, environmental activists have already arrived in force in Davos to protest – amongst other things – the hypocrisy of the global elite travelling to the resort in private jets amid an escalating climate crisis.

In previous years, Greta Thunberg has been invited to speak on panels at the event, as well as leading her School Strike with local youth activists. In May, the Arctic Base Camp pitched up on the Schatzalp – the peak overlooking Davos – to bring attention to the impact of climate change on communities around the world.

“A failure to mitigate climate change is ranked as one of the most severe threats in the short term but is the global risk we are seen to be the least prepared for,” WEF experts wrote in its Global Risks Report published last week.

While the climate has consistently been on the Davos agenda for the last decade or so, it has arguably been pushed down the list of priorities. As it was in May by Ukraine, it is likely to be overshadowed again this year by a cost of living crisis that has been exacerbated by many factors, including inflation, rising fuel costs, and food shortages.

One of the big topics around climate change this year is set to be the process of decarbonisation industries and the energy transition. Investment in and the scaling up of new technologies, including more sustainable fuel sources, is a particularly pronounced topic with green hydrogen becoming a big buzzword this year.

The growing food crisis

Food insecurity, as with many challenges listed in this article, is largely interconnected with other global problems, key among them being the climate crisis.

The loss of biodiversity, ever-extreme weather, and the increasing number of natural disasters have played their part in growing food shortages.

In 2022, the world faced the triple threat of food, energy, and fertiliser shortages. Experts are already warning that more people will face hunger in 2023 than the previous years as food prices continue to spike, shortages bite deeper and more livelihoods are decimated.

How do we turn the situation around and avert inevitable future food crises? It’s a question that will be earnestly posed and debated at this year’s event.

The ‘Fourth Industrial Revolution’

Technology and innovation are always key to all discussions at Davos. This year in particular, talk is turning to what many are calling a Fourth Industrial Revolution.

Increased interconnectivity, as well as advancements in areas such as artificial intelligence and quantum computing, are bringing with them thorny issues around governance.

Historically, regulation has been slow to keep pace with the surge in technological advancements. Increasingly, governments are choosing to take a more localised approach to this, especially given concerns over their country’s national security.

However, with many crises now presenting themselves all at once – climate, war, cybersecurity, and so on – a more globalist approach is needed to unlock the potential of innovation to help solve the greatest challenges we are facing.

What would this mean? On a base level, it would require greater cooperation between companies and at a higher level, countries – to build trust and put safeguards in place.

Business

MEPs Urge Orban, To Act To Unlock EU Money

MEPs in charge of controlling the spending of EU funds continue to be “greatly concerned” about how Hungary manages EU money. They have called on Prime Minister Viktor Orban to implement reforms that will unblock EU funds that are currently suspended.

Monika Hohlmeier, a German MEP of the centre-right party, told reporters in Budapest on Wednesday (17th May) that “our goal is not to stop money; our goal is to spend the money in Hungary.”

The delegation of the European Parliament’s budget control committee reviewed the progress of the implementation of 27 super milestones – the measures that the EU Commission has set forth for the Hungarian government to unfreeze Cohesion and Covid Recovery Funds.

Hohlmeier stated that Hungary should implement measures “as quickly and as soon as possible”.

Last December, the EU countries approved a plan to grant Hungary EUR5,8bn under the bloc’s Covid-19 Recovery Plan, on the condition that Budapest implement 27 reform targets. These included strengthening judicial independence, and putting new anti-corruption measures in place.

The EU also suspended EUR6.3bn of cohesion fund payments to Hungary due to concerns about rule-of-law, which the EU claimed put the budget of the bloc at risk.

The negotiations between the government of Hungary and the commission are ongoing, but without any breakthrough.

MEPs do not have a direct say in the unlocking of funds. The European Parliament has kept up political pressure on EU officials to ensure that Hungary adheres to EU rules regarding independent judiciary, and fights corruption before receiving EU funds.

“The picture that emerged” […] Lara Wolters, a Dutch left-wing MEP, said that the lack of information regarding financial oversight of government expenditures, as well as issues in control audits of public procurements and conflict of interests, is a major concern for us.

“Real structural change is the only way to bring about real change.” [changes]She added that the media in Hungary was hostile towards the committee.

Media close to the government asked the MEPs at the press conference if EU money was connected to Hungary’s rejection to perceived EU policies regarding migration, gender and Ukraine. They also asked if the MEPs supported the delivery of weapons to Ukraine and what they thought of corruption in Brussels.

Petri Sarvamaa, a centre-right MEP from Finland, said in Budapest: “We don’t invent this stuff.” He added: “Our only purpose is to make sure that the EU budget in any member state is not at risk. This is not about Hungary.

Hohlmeier also added that the committee traveled to Spain Italy and Bulgaria to monitor EU expenditure.

Daniel Freund, German Green MEP, however, said that despite his eighth visit to Hungary he found “unthinkable” things in any other EU country.

“A rule by decretal, a state emergency for eight years, now ongoing, 95 amendments to the budget [in 2022] “Armed inspections of a food pantry by the tax authority without the participation of the national Parliament,” Freund said.

“We want EU funding to go to Hungary to build schools, put solar panels on the roofs, have fast internet everywhere and to provide social assistance to Hungarians who are most vulnerable,” he said.

“But we do not want EU funds to be used to enrich the family members and friends of Mr Orban, by breaking EU rules regarding fight against corruption and prevention of conflict of interest,” Freund added.

Tibor Navracsics said on Wednesday that he believed the European Parliament delegation had not read all the background material sent to them in advance.

According to media reports, he also claimed that political biases had influenced many MEPs’ opinions and that as a result factual errors have been made in some cases.

Business

Growing Fear EU Firms In Russia May Be Forced To Finance War

The EU is preparing to assist their companies in leaving Russia amid the growing risk that they will be taxed and used to fund the war of Russian President Vladimir Putin.

The proposals for the 11th round Russia sanctions, as seen by EUobserver include special new permits and legal services to help European companies get out.

Since the beginning of the war, more than 1,600 Russians and Russian entities have had their assets frozen by EU.

The 11th round adds another 100 names.

The new proposal allows EU countries to authorize financial transfers to Russians on the blacklist “after determining that such funds or resources are necessary to complete transactions, including sales which are strictly required for the winding down, by 31 August 20,23, of a joint-venture or similar legal arrangement established with this person or an entity owned or controlled by this person before 28 February 2020”.

The EU also banned European law firms providing commercial services to Russian customers.

The 11th round proposal is intended to ease this as well, in order to help untangle the related EU-Russian interests within Europe.

The proposal stated that “Competent Authorities of the Member States may Authorise until 31 Dec 2023 the Provision of Legal Services which are Mandatory… for such divestments, such as Notary Services”,

According to a running count kept by Yale University, the US, and last updated on May 16, more than 1,000 foreign companies have already fled Russia in the past year.

There are still dozens of large European companies operating in Russia.

Some of the biggest European banks (Deutsche Bank ING Bank Raiffeisen Bank International UniCredit, OMV and Total) and energy companies (Engie, OMV and Total) are included.

This includes well-known brands such as Armani Benetton Diesel Lacoste and Lacoste.

Also included are the following: Austrian energy drink maker Red Bull; Danish medical equipment manufacturer Coloplast; Dutch consumer goods company Phillips and drinks producer Heineken; Estonian taxi firm Bolt and French hotel chain Accor, Clarins cosmetics maker and German engineering firm Bosch.

Staying in Russia for the past year has been a calculated risk of financial reward versus reputational risk.

Since the war, the share value of Austria’s Raiffeisen Bank International fell by 40 percent due to the opprobrium that comes with staying in place.

According to the independent Russian newspaper Novaya Gazeta, profits from its Russian operations reached a record EUR2.2bn by 2022, which accounted for more than 60% of total profits.

Russia is making it difficult for its old friends in the West to leave.

The Foreign Investment Commission of the Russian Finance Ministry now requires strategic firms, such banks and energy companies to obtain permission from the commission to sell Russian assets.

Novaya Gazeta reported that the government only issues 10 or so permits per month, despite a waiting list of 700 applicants.

In March, Russia made matters even worse by stating that foreign firms would have to pay a 10% tax on assets sold if they decided to leave.

The Russian Finance Minister Anton Siluanov said at the time that “we are creating conditions so… exit is not beneficial for foreign business”.

The new legislation that is coming could make staying even more of a financial and moral risk than before.

Due to favorable double-taxation agreements, most European companies paid little or no tax on their profits in Russia.

But, in March, the Finance Ministry proposed freezing these tax treaties with about 40 “unfriendly countries” that imposed sanctions against Russia, including the EU 27.

Putin has not yet implemented the proposal, but it is a matter that could be decided by a presidential order at any time.

His symbolism could be exposed after the EU imposes the 11th round in the coming weeks.

Putin also publicly asked on 2 May that his government “clarify” how it will handle dividend payments in the future to shareholders from “unfriendly” countries.

According to a Russian source who requested anonymity due to the sensitive nature of the information, new rules could see an up to 25% tax imposed on the Russian profit of EU firms like Armani, Clarins and Raiffeisen, as well as the rest of those who stayed.

Russian trap

Source: Siluanov’s exit fee of 10 percent could lead “Western companies unaware of the future dividend taxes to maintain some presence in Russia”, the source said.

“But once you’ve done that, [double-tax] After the termination of agreements, Moscow will impose new taxes on Western companies that are still present in Russia. They would be required to pay a tax on dividends up to 25%,” the source said.

EUobserver reported that “this would actually turn these companies into sponsors of Russian war efforts”.

The EU Foreign Service never comments on details about upcoming sanctions such as its motivations for suddenly lubricating European divestments.

It also told this site that advice to private companies was a primary matter of national competency.

It added: “This time is not the right time to do business with Russia or in Russia because of its war against Ukraine, and due to the unpredictable nature of the local economy, investment and rule of law environments.”

This was only one of many warnings that Putin was preparing a bribe to foreign investors.

Exiled Russian tycoon Mikhail Khodorkovsky – whose oil company Yukos was seized 15 years ago by the Kremlin – warned on 2nd May that Putin had “demonstratively constructed an illegitimate, lawless state”.

“The withdrawal of assets was something that should have been started long ago, even before war. And on 24 February 2020 [the date of the Ukraine invasion]Khodorkovsky stated that the decision should have been taken.

Business

[Exclusive] MEP Luxury Pension Held Corporate Assets In Tax Havens

![[exclusive]-mep-luxury-pension-held-corporate-assets-in-tax-havens](https://eurotimes.eu/wp-content/uploads/2023/05/1420-exclusive-mep-luxury-pension-held-corporate-assets-in-tax-havens.jpg)

While the European Parliament was demanding a clamp down on tax havens, many of its own MEPs were using their monthly office allowances to finance a luxury pension scheme that held corporate assets in the Cayman Islands, Bermuda and elsewhere.

The investments, including in large banks requiring bailouts, were made at the height of 2008-2010 financial crisis that had ushered in mass unemployment and austerity cuts affecting ordinary Europeans.

Among those were 16,000 shares of Cayman Islands based Teck Resources Ltd, Canada’s largest diversified mining firm. The shares were held shortly before the European Parliament passed a resolution slamming the role played by tax havens in encouraging and profiteering from tax avoidance.

“When investments take place through jurisdictions such as Cayman Islands and Bermuda, it should definitely make the alarm bells go off,” said Tove Maria Ryding of Tax Justice advocacy group.

Ryding said that although not all investments through these jurisdictions are problematic, they should definitely be a reason for introducing extra precaution and high standards of transparency.

The latest revelation also comes at a time when the European Parliament is trying to regain public trust in the wake of the Qatargate corruption scandal, where one of its now former vice-presidents is awaiting trial wearing a police ankle monitor.

The investments were made on the behalf of a so-called voluntary pension fund, a Luxembourg-based scheme that is currently running a €379m actuarial deficit and which may require a taxpayer bailout as as early as next year. MEPs at the time only had to contribute two years into the fund in order to then receive a pension for life.

The parliament’s secretive leadership, known as the Bureau, is currently scrambling for solutions in the hopes of avoiding another public relations disaster ahead of the 2024 European elections.

The issue has riled critical MEPs who have for years been piling on pressure for the Bureau to come up with answers but to no avail. Among them is Monika Hohlmeier, a German centre-right MEP who chairs the powerful budgetary control committee.

“The Voluntary Pensions Fund has been causing me serious headaches for some time now,” she said, in an email.

“When I now hear that the investment strategy included assets in tax heavens such as the Cayman Islands, then it just adds to the ever-growing list of problems this fund accumulated”, she said.

Coal mine shares aside, the fund also held numerous shares in the Bermudas, as well in other tax havens like Hong Kong, Singapore, and Switzerland. The fund eventually bounced back to pre-global financial crisis figures, noted asset managers in a 2011 report.

EUobserver obtained the list of investments spanning 1994 to 2010 from the Luxembourg business register.

But the breakdown of individual investments stops post 2010 with the European Parliament refusing to release any further details.

“The voluntary and complementary pension fund for MEPs was created in 1990, when there was no single statute for MEPs,” said a spokesperson from the European Parliament.

“The fund was closed in 2009, when the new MEPs’ single statute entered into force,” she said, noting the fund is a non-profit association governed by Luxembourgish law.

Although no longer open to MEPs since 2009, the fund is still making investments today on their behalf.

Asked about those investments, she said the European Parliament was unable to comment because the fund is a “third party”.

This comes despite the fund’s board being composed of sitting MEPs, including Janusz Lewandowski and European parliament vice-presidents Othmar Karas and Roberts Zile.

Zile is the parliament’s document gatekeeper. Late last year, he refused a freedom of information request filed by EUobserver to disclose additional information on the voluntary pension fund.

And earlier this month, the European Parliament passed its budget report and called upon the Bureau to clarify the entitlements of current and past MEPs stacking up multiple pensions.

The Greens had tabled an amendment demanding MEPs withdraw from the voluntary pension fund if they already receive another pension.

But that amendment was voted down 272 against 203. Among those rejecting it were Lewandowski, Karas, and Zile. The latter two are beneficiaries of the voluntary pension fund.

Other notable beneficiaries include the EU’s foreign policy chief Joseph Borrell as well as former European climate commissioner Miguel Arias Canete and others.

-

Health & Society6 days ago

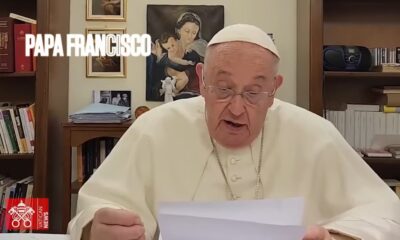

Health & Society6 days agoPope Francis calls on religions to unite to reduce demand for drugs

-

EU & the World6 days ago

Mike Lynch Yacht Update: Fifth Body Recovered Off Coast of Sicily

-

EU & the World6 days ago

EU & the World6 days agoAshanti & Nelly Welcome First Child Together & Reveal Baby Boy’s Name

-

EU & the World6 days ago

EU & the World6 days agoDoes Travis Kelce Appear in Swift’s ‘I Can Do It With a Broken Heart’ Music Video?

-

Sports6 days ago

Sports6 days agoAtalanta: PSG-Lookman, there is news

-

Politics6 days ago

Politics6 days agoPoland’s Former Prime Minister Mateusz Morawiecki Eyes Leadership of European Conservatives and Reformists

-

Travel7 days ago

New Brussels to Venice night train: The 9 cities en route, what it will cost and how to book

-

Health & Society6 days ago

Health & Society6 days agoSexual abuse, electric shocks, chemical restraints in Mental Health Care, report finds